utah non food tax rate

TAXABLE In the state of Utah the foods are subject to local taxes. Utahs sales tax rates for commonly exempted categories are listed below.

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

You prepare and sell a fruit basket in a wicker basket as one item.

. See taxutahgovsalesrates for current rates. TAP will calculate the Sales and Use Tax and transfer the amounts onto the Main return. Utah tax forms are sourced from the Utah income tax forms page and are updated on a yearly basis.

While 32 states exempt groceries six additional states Arkansas Illinois Missouri Tennessee Utah and Virginia tax groceries at a lower preferential rate. Streamlined Sales Tax Agreement Definition. Amendments to definitions and provisions relating to the Utah sales and use tax on food and food ingredients become effective January 1 2007.

Source their sales based on the ZIP 4 of the customers address. Out-of-state sellers should source their sales based on the ZIP 4 of the customers address. 91 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Utah Food Tax Reduced Definitions Modified. Enter the Tax Rate.

Tax years prior to 2008. Grocery food is food sold for ingestion or. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835 Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Utah has a single tax rate for all income levels as follows. Utah has recent rate changes Thu Jul 01 2021. You can lookup Utah city and county sales tax rates here.

While food and food ingredients remain subject to county and local taxes the state sales and use tax rate is reduced from 475 to 275. Four of those six states include both candy and soda in the rate applied to those lower-taxed groceries. Before the official 2022 Utah income tax rates are released provisional 2022 tax rates are based on Utahs 2021 income tax brackets.

21810 for a 20000 purchase Park City UT 905 sales tax in Summit County 21220 for a 20000 purchase Tremonton UT 61 sales tax in Box Elder County You can use our Utah sales tax calculator to determine the applicable sales tax for any location in Utah by entering the zip code in which the purchase takes place. You collect tax at the grocery food rate 3 percent on the grocery food and the combined sales tax rate at your location for the clothing. Some rates might be different in Grand County.

Click File now located in the Period box or. January 1 2008 December 31 2017. In resort communities the Resort Exempt rate is the Combined Sales and Use tax rate minus the resort community tax.

Sales and use tax rates vary throughout Utah. 274 rows 696 Utah has state sales tax of 485 and allows local governments to collect a. The fruit is grocery food but the wicker basket is not.

The entire combined rate is due on all taxable transactions in that tax jurisdiction. When finished Save the template. Poverty advocates have begged lawmakers not to raise the sales tax on food from its current 175 to 485 arguing this increase would disproportionately fall on low-income people who spend a.

Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah. TC-40B Non or Part-year Residents.

GR The general state sales and use tax rate LR A lower sales and use tax rate imposed on food E Exempt -- No sales and use tax imposed. Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. There are currently about 363000-373000.

January 1 2022 current. Return to TAP and Sign in to your account. Both food and food ingredients will be taxed at a reduced rate of 175.

Click File view or amend returns located in the Account box. Back to Utah Sales Tax Handbook Top. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465.

Food and food ingredients does not include an alcoholic beverage tobacco or prepared food. If a locality within a county is not listed with a separate rate use the county rate. These rate charts should not be used for sourcing sales from out-of-state sellers to locations in Utah.

The 2022 state personal income tax brackets are updated from the Utah and Tax Foundation data. The tax on grocery food is 3 percent. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food.

With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. Previous studies have found that for every 1 the state increases the sales tax on food food insecurity goes up by 6 for non-SNAP eligible households. Grand County Sales Tax Calculator Purchase Details.

For more information see https. Utah UT Sales Tax Rates by City W Utah UT Sales Tax Rates by City W The state sales tax rate in Utah is 4850. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

Utah has a single tax rate for all income levels as follows. Select the Utah city from the list of cities starting with W below to see its current sales tax rate. Date Range Tax Rate.

With local taxes the total sales tax rate is between 6100 and 9050. Use the Use Tax Rate List below to get the rate for the location where the merchandise was delivered stored used or consumed. Municipal governments in Utah are also allowed to collect a local-option sales tax that ranges from 125 to 42 across the state with an average local tax of 211 for a total of 696 when combined with the state sales tax.

The maximum local tax rate allowed by Utah law is 335. Contact us for assistance. The state sales tax rate in Utah is 4850.

January 1 2018 December 31 2021.

Sales Tax On Grocery Items Taxjar

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

States With Highest And Lowest Sales Tax Rates

State And Local Sales Taxes In 2012 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Are State Taxes Becoming More Regressive Rev 10 29 97

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

How To Charge Your Customers The Correct Sales Tax Rates

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Utah Sales Tax Small Business Guide Truic

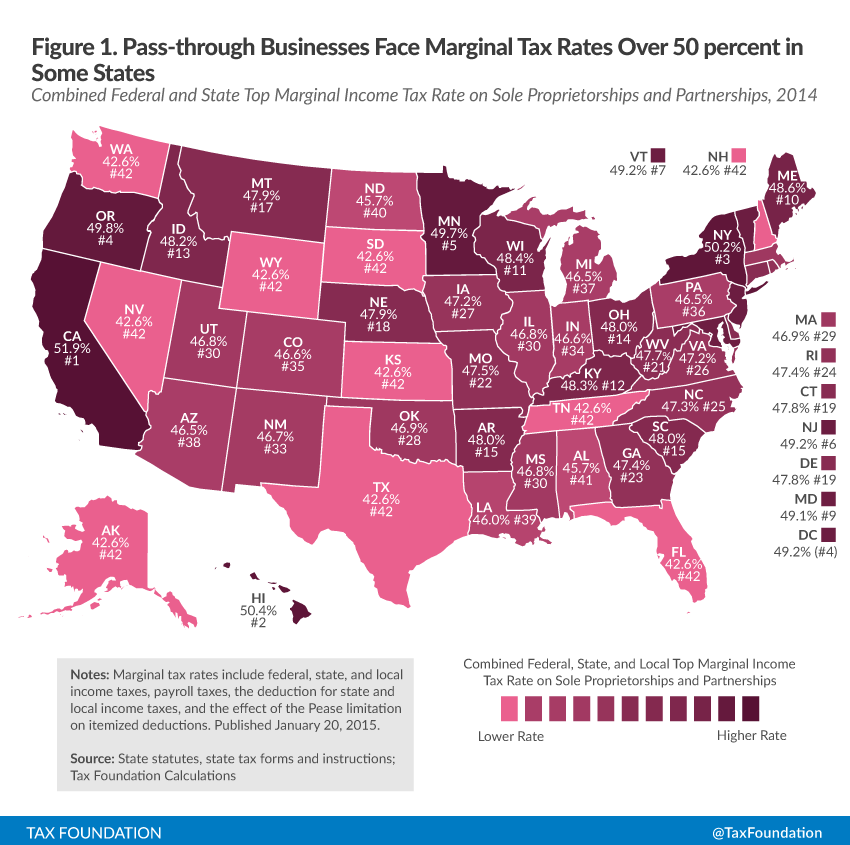

An Overview Of Pass Through Businesses In The United States Tax Foundation

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)